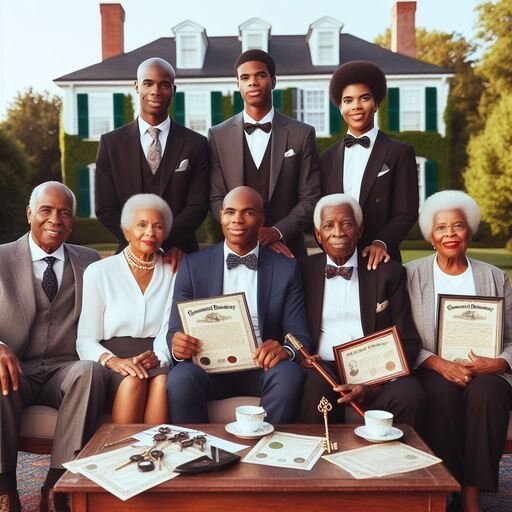

The Significance of Generational Wealth

Generational wealth encompasses assets, investments, and financial knowledge that are passed down from one generation to the next. It serves as a safety net during challenging times, enables educational opportunities, homeownership, and entrepreneurship, and empowers families to achieve their dreams.

In African American communities, the importance of generational wealth is amplified due to historical disparities in wealth accumulation. The legacy of slavery, segregation, and discriminatory practices has had a lasting impact on economic opportunities. Therefore, the creation and preservation of wealth take on even greater significance as a means to bridge these disparities and empower future generations.

The Role of Life Insurance

Life insurance plays a pivotal role in the journey to generational wealth for several reasons:

1. Financial Protection

Life insurance provides a financial safety net for your loved ones in the event of your passing. The death benefit can cover funeral expenses, outstanding debts, and ongoing living expenses. This ensures that your family is not burdened by financial hardship during an already difficult time.

2. Wealth Transfer

Life insurance serves as a tax-efficient means of transferring wealth to the next generation. The proceeds from a life insurance policy are generally received tax-free by beneficiaries, allowing them to inherit assets without the burden of estate taxes.

3. Estate Planning

Life insurance can be a valuable component of your estate plan. It can help equalize inheritances among heirs, ensuring that assets are distributed according to your wishes. This is particularly important in cases where certain family members may not have access to other forms of wealth.

4. Legacy Preservation

Life insurance enables you to leave a lasting legacy for your family. It provides the financial resources necessary for children and grandchildren to pursue education, start businesses, or invest in their own financial future. This empowers future generations to achieve their goals and aspirations.

Overcoming Challenges

While life insurance is a powerful tool for building generational wealth, access to this essential financial product has historically been limited for many African American families. Lack of awareness, affordability concerns, and mistrust of the insurance industry have contributed to lower rates of life insurance coverage.

Legacy Planning & Preservation Corporation is committed to addressing these challenges by providing education and access to life insurance products tailored to the needs of African American communities. We believe that by empowering individuals and families with the knowledge and resources to protect their financial future, we can contribute to the creation of generational wealth that will endure for generations to come.

As we celebrate Black History Month, let us recognize the importance of building and preserving generational wealth in African American communities. Life insurance is not just a financial product; it is a means of securing the future and leaving a legacy that empowers our children, grandchildren, and generations beyond. Together, we can ensure that the journey to generational wealth continues, breaking down barriers and creating opportunities for all.